Writing succinct and accurate job descriptions for financial managers can be challenging. Financial managers can be involved in diverse activities, from risk management to investment management, and need a mix of hard and soft skills for success.

Unfortunately, many organizations don’t specify these details in their job descriptions. They also minimize their company culture, failing to communicate their values and unique benefits.

Risking any of these mistakes in your job descriptions can attract unqualified candidates who can damage productivity, employee morale, and the financial health of your business.

Fortunately, we’ve got your back. Below, we’ll cover how to write an effective financial manager job description, how to attract and assess top talent, and more.

Table of contents

- What is a financial manager?

- Key skills to look for in financial managers

- How to write an effective financial manager job description

- Financial manager job description template

- 3 things to avoid when writing a job description for financial managers

- Next steps: Attracting and assessing financial manager candidates

- FAQs

- TestGorilla helps you hire the best financial managers

What is a financial manager?

A financial manager oversees an organization's financial activities and operations, making informed decisions about investments, budgeting, and forecasting.

Their main goal is to ensure the organization’s financial health and their decisions influence its long-term sustainability and growth.

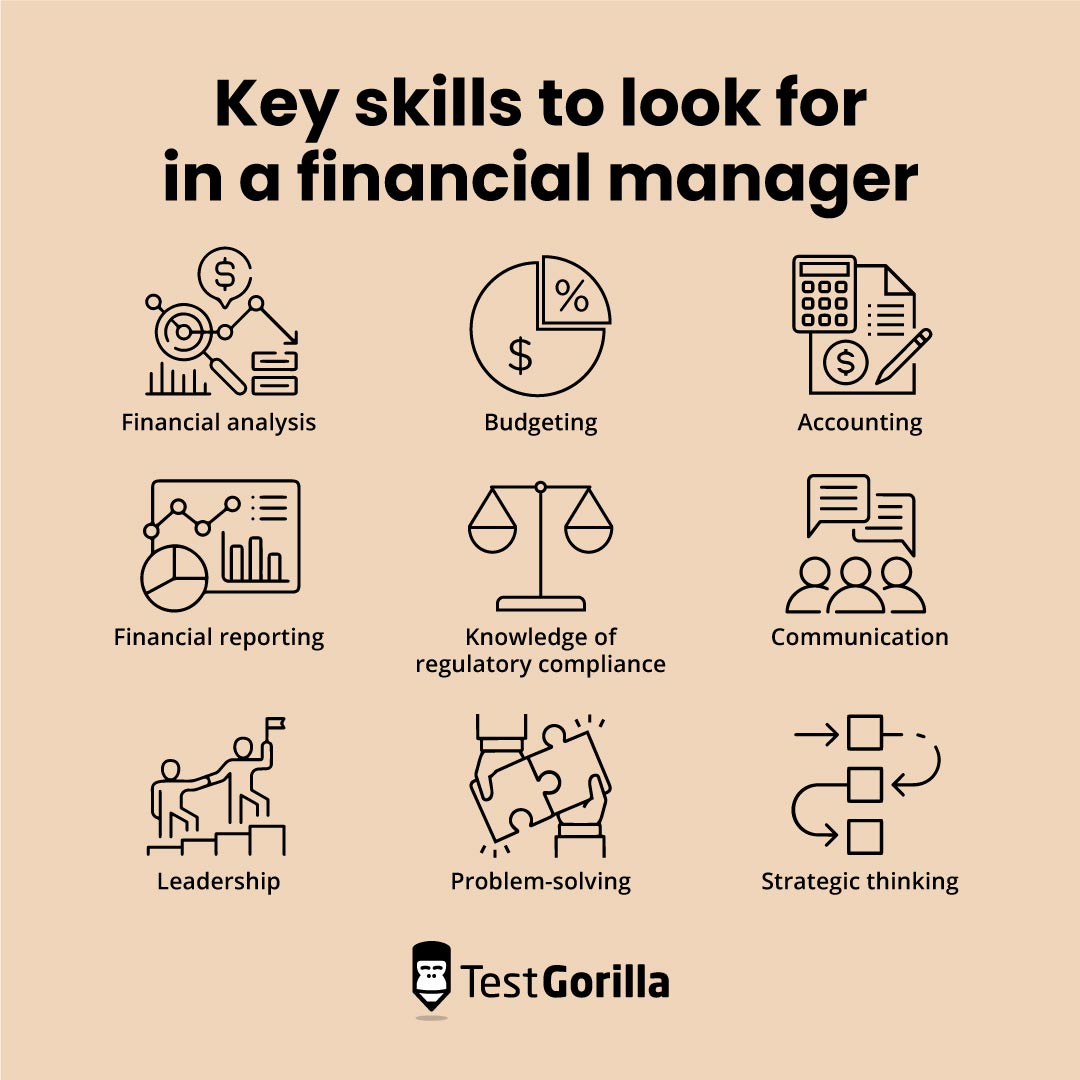

Key skills to look for in financial managers

Qualified financial managers possess the following key hard and soft skills.

Financial analysis: Ability to interpret financial data to make informed decisions

Budgeting: Analyzing historical data, market conditions, and company objectives to develop accurate budgets that align with the organization's goals

Accounting: Understanding and applying accounting principles to manage finances

Financial reporting: Generating precise and timely financial statements

Knowledge of regulatory compliance: Ensuring the organization's financial activities adhere to relevant laws and regulations

Communication: Conveying complex financial information clearly to non-financial stakeholders

Leadership: Directing a financial team and making decisive choices

Problem-solving: Addressing financial challenges and finding effective solutions

Strategic thinking: Planning for the long-term financial health of the organization

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

How to write an effective financial manager job description

Here are three tips to help make your financial manager job description shine:

Take a skills-based approach

Skills-based job descriptions prioritize an individual's skills and abilities over non-essential degree requirements. They also spotlight opportunities for continuous learning and development.

This type of job description can help you draw a wider talent pool because it encourages individuals from non-traditional backgrounds to apply.

To take a skills-based approach with your job description, focus on the specific skills a financial manager should have – whether those are threat identification or managing short-term investments. Also, consider including academic degrees as preferred qualifications rather than strict requirements.

Highlight key responsibilities

Ensure you list the tasks your financial manager will handle, such as monitoring daily cash transactions, preparing quarterly financial reports, and analyzing cost-caving opportunities.

When listing these responsibilities, you can rank them by importance, from key tasks like managing investment portfolios to occasional ones like conducting annual financial audits. You can also arrange them chronologically – beginning with daily duties like reviewing daily expenses, followed by monthly and quarterly tasks your new hire will work on down the line.

This way, potential applicants can clearly understand the job’s day-to-day responsibilities and decide if their skills and experience match them. This can help ensure you receive applications from only the most qualified professionals.

Bring your company culture to the forefront

Emphasizing your positive workplace culture in your job description allows applicants to assess whether their values and beliefs align with your organization’s. Individuals who resonate with your company's ethos are more likely to be committed, motivated, and a good fit for long-term collaboration.

In your job description, include information about your work environment, team dynamics, and your organization’s approach to challenges. For example, you might mention that your company champions innovative thinking to navigate financial hurdles. Spotlighting this can draw candidates who value creativity and innovation.

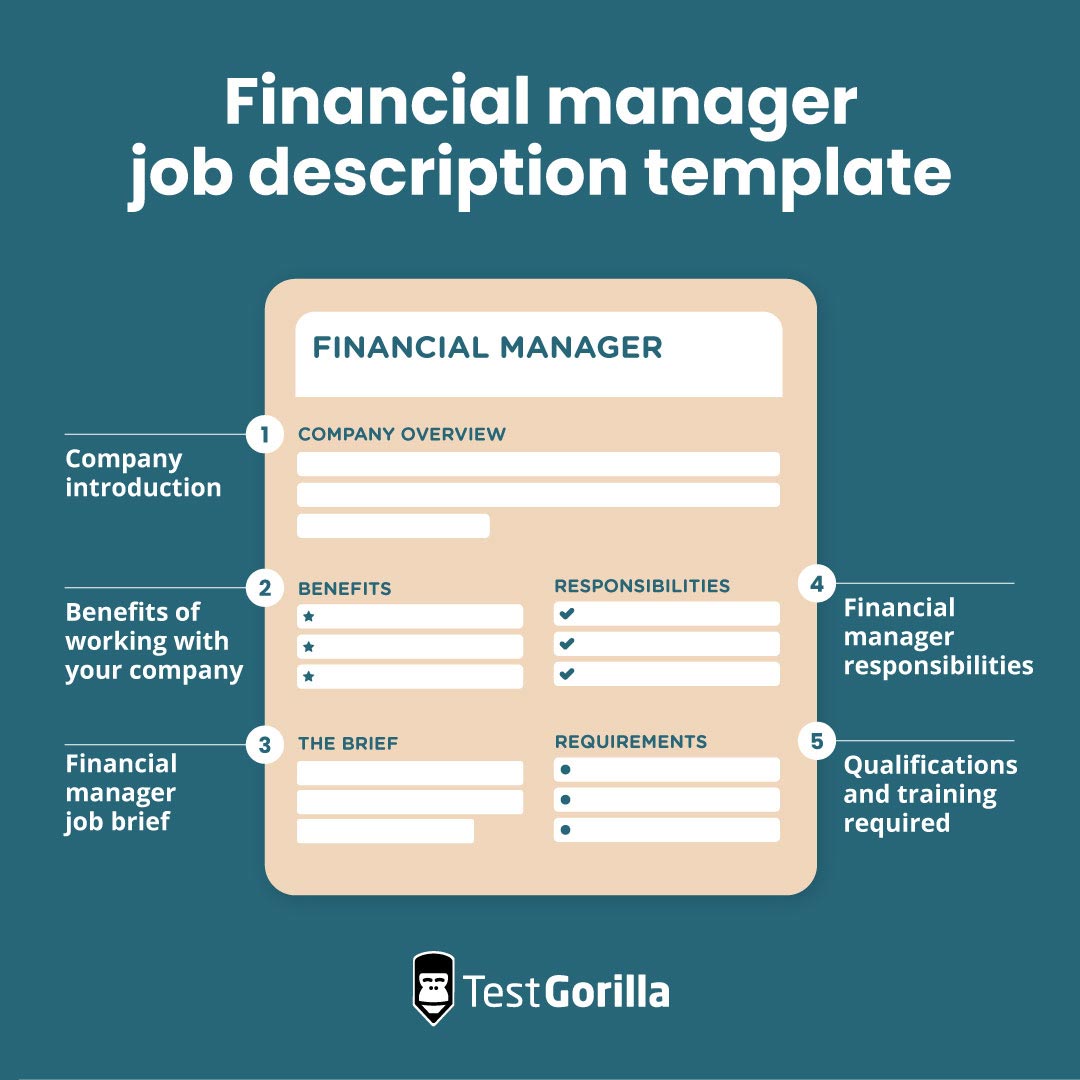

Financial manager job description template

Here’s a template to help you write a great job description for financial manager roles.

Company introduction

In this section, describe your company’s culture, industry reach, size, and mission. Give a snapshot of your organization's operations and foundational values, emphasizing your long-term priorities and goals.

Also, explain why you're hiring a financial manager and how their role will fit with your current teams.

Benefits of working with [your company]

This is where you emphasize the unique benefits of working with your organization. You can discuss compensation and benefits – like a competitive salary, unlimited paid time off, and generous family leave – and non-monetary benefits like professional development opportunities.

Financial manager job brief

[Company name]

Job title: [For example, Junior Financial Manager or Lead Financial Manager]

Reports to: [For instance, Lead Financial Manager, Director of Finance, or Chief Financial Officer]

Position type: [Full-time, part-time, on-site, remote, or hybrid]

[Salary and benefits information]

Responsibilities

Creating financial plans to estimate earnings and costs, assisting in making decisions and designating resources

Dividing yearly budgets into monthly or quarterly parts to make sure each department receives appropriate the funds

Monitoring receivables, payables, and inventory levels to improve cash handling

Evaluating potential projects and acquisitions, analyzing their costs and benefits, and determining their return time

Using financial tools, like forwards and options, to reduce risks from changing currency values or interest rates

Securing favorable loan terms by negotiating with banks and issuing corporate bonds, ensuring the organization's debt-to-equity ratio stays healthy

Working closely with tax experts to explore tax-saving opportunities and ensure compliance with all local and international tax regulations

Regularly reviewing the skills and competencies of the finance team, arranging for ongoing training or workshops to stay current with financial trends and software

Qualifications and training

Bachelor’s degree in finance, business administration, or a related field (master’s degree preferred)

Proficiency in financial software tools like SAP, Oracle Financials, or other enterprise resource planning (ERP) systems

Strong understanding of financial regulations, corporate finance principles, and budgeting practices

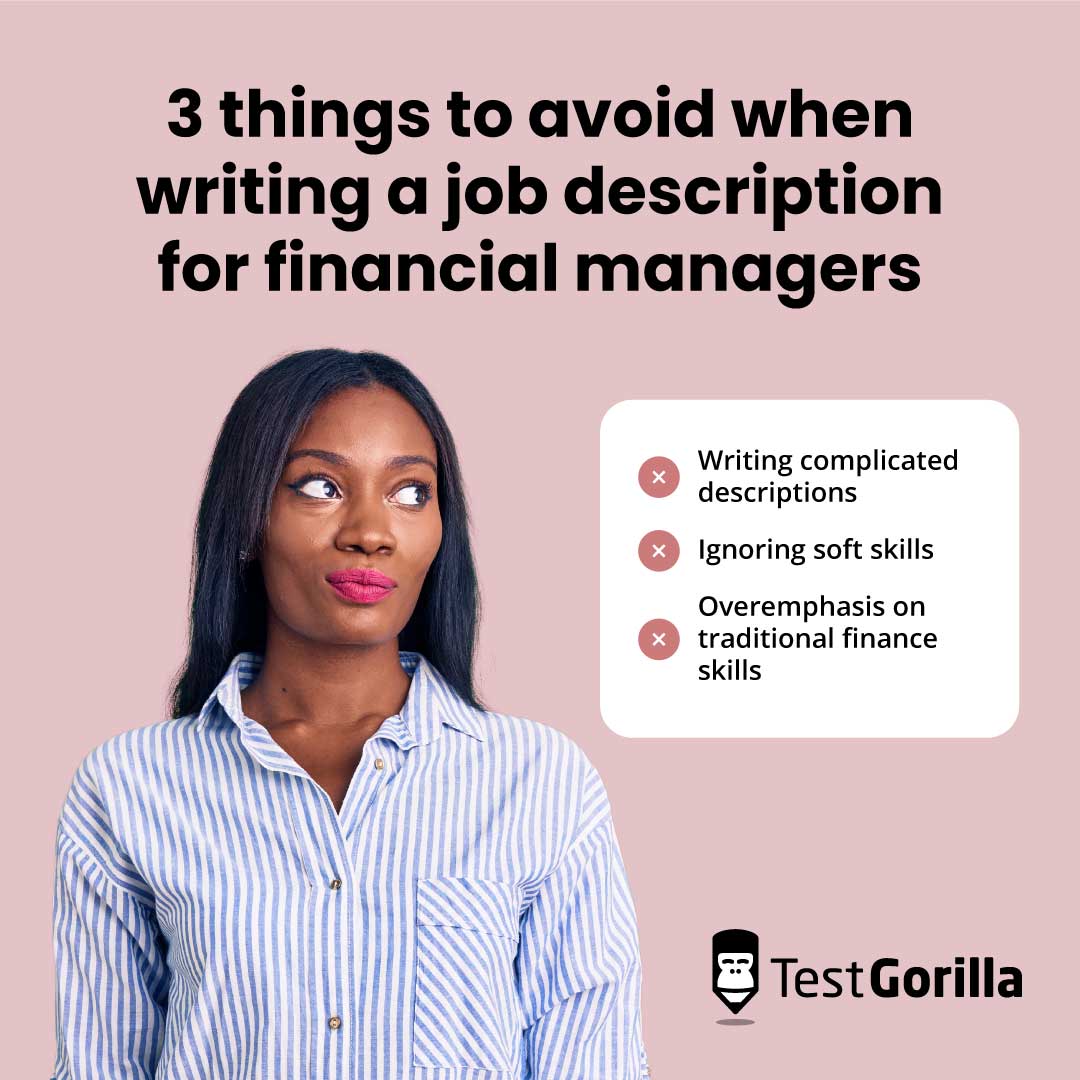

3 things to avoid when writing a job description for financial managers

Here are three practices to avoid when crafting your financial manager job descriptions.

Writing complicated descriptions

Wordy, jargon-filled job descriptions can overwhelm and deter potential applicants. To avoid this, focus on core responsibilities and qualifications, using plain language free of industry jargon when possible.

For example, instead of asking for “Experience in leveraging EBITDA optimizations for capital allocation strategies," simplify to “Experience in improving earnings before taxes and using those improvements to decide where to invest."

Ignoring soft skills

Although a financial manager's expertise in budgeting, forecasting, and risk management is essential, soft skills like leadership, negotiation, and effective communication are equally important.

Failing to highlight these attributes in your job description could lead to hiring candidates who excel technically but face collaboration and stakeholder engagement challenges.

Overemphasis on traditional finance skills

Don't just focus on conventional finance skills like accounting and financial reporting. Today's financial managers also need to know how to analyze data, manage risks, think strategically, and use technology. For example, they might use software to make budgets and predict future trends.

By excluding these skills from your job description, you risk misrepresenting the dynamic nature of the role, which can deter top talent from applying.

Next steps: Attracting and assessing financial manager candidates

After crafting your financial manager job description, share it on popular job boards, social media, and other relevant platforms where qualified candidates can see it. As applications come in, start evaluating standouts to hire your new financial manager.

TestGorilla is the ideal platform to do this. It offers more than 300 tests that measure candidates’ job-related skills, personality traits, cognitive abilities, and more.

For example, our Financial Management test helps identify candidates with strong capital management and investment appraisal skills, while our DISC Personality test reveals candidates’ personality types to understand how each collaborates and communicates.

Combining these tests gives you a more complete picture of a candidate. You can even mix and match tests depending on the nature of your specific role. For example, try pairing TestGorilla’s Due Diligence test and Leadership and People Management test to evaluate candidates' financial competency and leadership skills.

After conducting tests to assess financial manager skills, you can hold structured interviews for even more insight into candidates. For ideas on what to ask, check out TestGorilla’s article on behavioral interview questions for finance roles.

FAQs

What are the three basic functions of a finance manager?

Primarily, a financial manager does three things:

Decides the right balance between borrowed and owned funds.

Picks projects that will yield a positive return on investment.

Chooses how to use profits – either putting them back into the business or giving them out as dividends.

How often should I update a financial manager job description?

Review and revise your job description at least once per year or when significant changes in the role, organizational structure, or finance industry standards exist.

TestGorilla helps you hire the best financial managers

Writing detailed, appealing financial manager job descriptions means focusing on required skills, the role’s responsibilities, and your organizational culture. This strategy helps you attract the best candidates for your open positions.

After you’ve completed your job description and grown your applicant pool, use TestGorilla’s library of 300+ tests to build assessments and evaluate your financial manager candidates quickly and objectively.

To explore how TestGorilla can help you find top financial managers, sign up for a free account, schedule a free 30-minute demo, or check out our product tour.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.